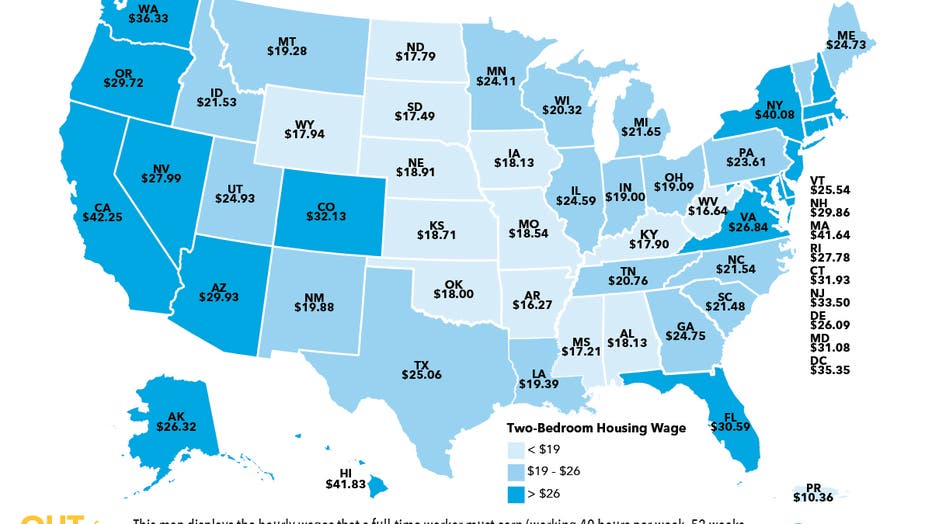

This map shows the hourly wage needed to afford rent in California

PREVIOUS COVERAGE: Housing in Orange County getting pricier

PREVIOUS COVERAGE: It takes $350,000 per year to afford a house in Orange County, a new study reveals.

LOS ANGELES - There appears to be no relief in sight for Californians as the cost of living continues to climb in the already expensive state and many are forking over far more than one-third of their income for housing.

While there are endless entertainment options up and down the California coast, some residents rarely get to enjoy them as they are too busy working to get by.

A study conducted by the National Low Income Housing Coalition (NLIHC) looked at the hourly wage needed to afford rent in every state in 2023, and to no one’s surprise, the Golden State topped the list. While housing costs continue to skyrocket, for many, renting is the more attainable option.

For fair market rent in California, a one-bedroom averages $1,767 and $2,197 for a two-bedroom.

SUGGESTED:

- California among top 3 states where most homes will cost at least $1 million by 2030: study

- US home prices have surged 47% since the start of 2020

- New study puts California in bottom 15 of ‘Best States to Live in’

- 10 safest cities in California, according to PropertyClub

The NLIHC study shows that in California, you need to make a whopping $42.25 an hour to afford a two-bedroom rental.

( National Low Income Housing Coalition (NLIHC))

That’s a far contrast from the $16.27 needed to afford a two-bedroom rental in Arkansas.

SUGGESTED:

- This is considered middle class income in California, study shows

- 12 cheapest places to live near LA, according to PropertyClub

- People leaving California moving here in record numbers, data shows

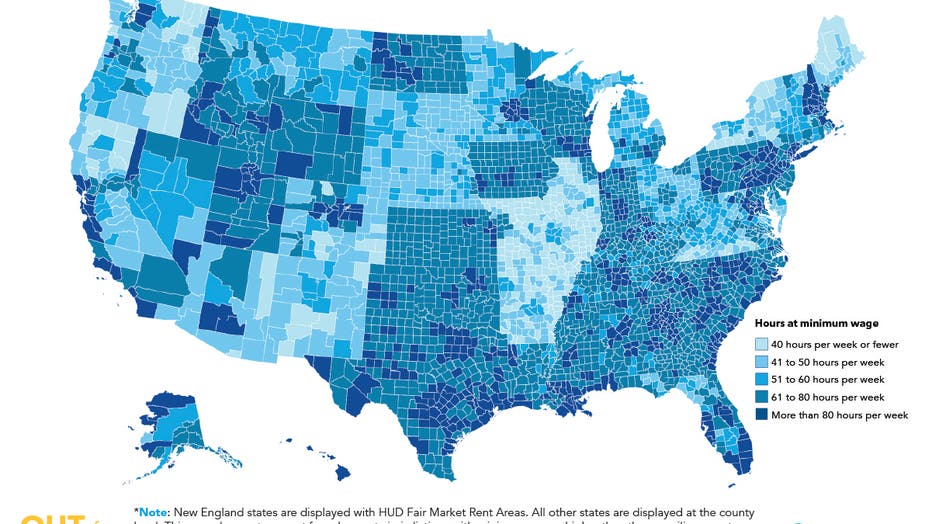

What’s even more alarming is the number of hours needed to work a minimum-wage job to afford rent. For several California counties, especially along the coastline, residents working minimum wage jobs had to work more than 80 hours per week even to afford a one-bedroom in 2023.

( National Low Income Housing Coalition (NLIHC))

It’s worth noting that in April 2024, a new law went into effect that requires most fast-food workers in California to be paid at least $20 an hour. This applies to restaurant chains with at least 60 locations.

PREVIOUS COVERAGE: New California laws 2024: Minimum wage up to $20 for fast-food workers

However, the struggle to pay rent is widespread and is felt beyond those who work in the fast food industry.

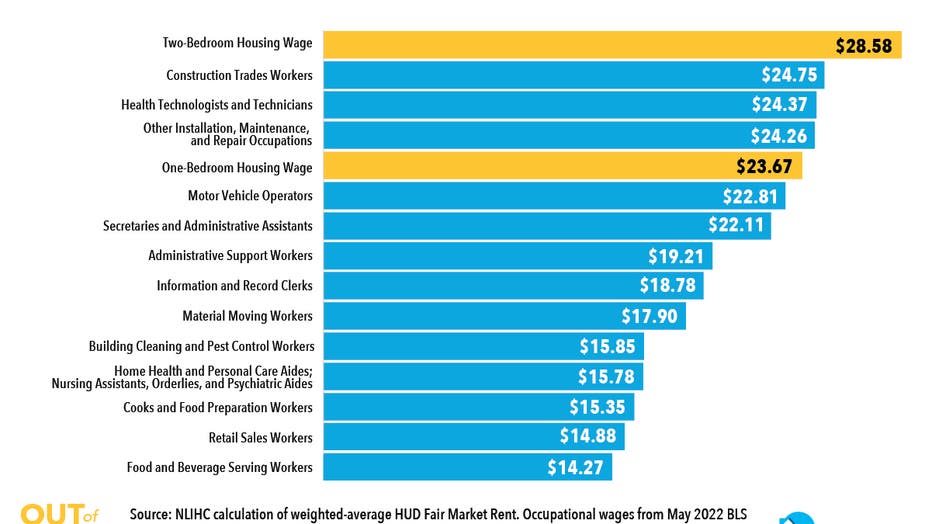

The study also shows that 13 of the 20 largest occupations in the nation pay less than what’s needed to afford a two-bedroom rental. This includes construction trade workers, material moving workers, administrative support workers, retail sales workers, nursing assistants, motor vehicle operators, and health technologists and technicians.

( National Low Income Housing Coalition (NLIHC))

How California Compares

Below is the hourly wage needed in each state that a household must earn to afford the fair market rent for a two-bedroom rental unit to avoid paying more than one-third of their income. This study is based on working 40 hours a week and 52 weeks a year.

- California – $42.25

- Hawaii – $41.83

- Massachusetts – $41.64

- New York – $40.08

- Washington – $36.33

- Wyoming – $36.33

- District of Columbia – $35.35

- New Jersey – $33.50

- Colorado – $32.13

- Connecticut – $31.93

- Maryland – $31.08

- Florida – $30.59

- Arizona – $29.93

- New Hampshire – $29.86

- Oregon – $29.72

- Nevada – $27.99

- Rhode Island – $27.78

- Virginia – $26.84

- Alaska – $26.32

- Delaware – $26.09

- Vermont – $25.54

- Texas – $25.06

- Utah – $24.93

- Georgia – $24.75

- Maine – $24.73

- Illinois – $24.59

- Minnesota – $24.11

- Pennsylvania – $23.61

- Michigan – $21.65

- North Carolina – $21.54

- Idaho – $21.53

- South Carolina – $21.38

- Tennessee – $20.76

- Wisconsin – $20.32

- New Mexico – $19.88

- Louisiana – $19.39

- Montana – $19.28

- Ohio – $19.09

- Indiana – $19

- Nebraska – $18.91

- Kansas – $18.71

- Missouri – $18.54

- Alabama – $18.13

- Iowa – $18.13

- Oklahoma – $18.00

- Kentucky – $17.90

- North Dakota – $17.79

- South Dakota – $17.49

- Mississippi – $17.21

- West Virginia – $16.64

- Arkansas – $16.27