This state wants to pay off $40K in student loan debt for first-time homebuyers

New details have been released about a bill in the Maine legislature that would offer significant student debt relief for first-time homebuyers in the state. (iStock)

Lawmakers in Maine are working on a bill that would forgive up to $40,000 worth of student loan debt for eligible first-time homebuyers.

Democratic Senate President Troy Jackson revealed the details of the Maine Smart Buy program during a public hearing on Feb. 22. He said that the program would address the state's labor shortage by attracting young workers who are seeking student debt relief.

"We’re counting on younger people to fill workforce shortages, keep our heritage industries going, and lead our state into the future," Jackson said. "With this program, we can make it easier for young people to create a meaningful, fulfilling life here."

Keep reading to learn more about student loan forgiveness in Maine, as well as what you can do to manage your debt if you're not eligible. One strategy is to refinance to a private student loan at a lower interest rate. You can compare student loan refinance rates on Credible for free without impacting your credit score.

STUDY FINDS THE TOP 5 UNDERGRADUATE DEGREES THAT PAY OFF

Maine Smart Buy proposes student debt relief for first-time homebuyers

Last June, Maine Gov. Janet Mills (D) signed a bill directing the Maine State Housing Authority (MaineHousing) and the Finance Authority of Maine (FAME) to develop a program that promotes homeownership by reducing student loan debt. After meeting several times during the third quarter of 2021, the agencies recently unveiled the program's details.

Maine Smart Buy is modeled after similar existing programs in Illinois and Maryland. To meet the eligibility requirements for student loan forgiveness under this proposal, you must:

- Purchase a mortgage through the MaineHousing First Home Loan Program. This first-time homebuyer program has an income limit of up to $131,100 and a maximum home purchase price of $695,000, depending on your household size and the county where you move. You'll also need a minimum credit score of 640 and a back-end debt-to-income ratio (DTI) of 45% or less to qualify.

- Have an existing student loan balance of at least $5,000. Homebuyers who are approved for the Maine Smart Buy program will receive an unsecured promissory note that's used to pay off their student loan debt balances. The promissory note will be equal to the amount of student loan debt you have at the time of closing, up to $40,000.

- Maintain the home as a primary residence. You would need to live in the home for at least five years to qualify for the full amount of debt forgiveness. The debt is forgiven at a rate of 20% per year — but if you sell the home before the five-year period expires, you'll only be responsible for paying the remaining balance of the promissory note.

The Maine Smart Buy program still hinges on approval in the Maine legislature, which is in session until April. If approved, the measure would be financed by a $10 million allocation from the state's general fund and run through the next fiscal year, which ends on Sept. 30, 2023.

"Lawmakers have an opportunity to attract and retain young people by supporting the program to increase homeownership and provide student debt relief," Sen. Jackson said.

If you're not eligible for this student loan forgiveness program, you may be considering your alternative debt repayment strategies like refinancing. You can learn more about student loan refinancing by visiting Credible.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON A HOME

What to do if you don't qualify for student loan forgiveness

Although the Maine Smart Buy program may someday offer student loan relief for some borrowers, it would benefit just a small fraction of the millions of Americans with student loans. Here are some alternative student loan repayment options to consider:

Read more about each strategy in the sections below.

Income-driven repayment

Federal student loan borrowers may be able to limit their monthly payments to between 10% and 20% of their disposable income under one of four income-driven repayment plans (IDR):

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)

The amount of your monthly student loan payment will depend on your income and family size, among other factors. After making payments on your loans for 20 or 25 years, your remaining student debt balance will be discharged. You can enroll in an IDR plan by signing in to your account on the Federal Student Aid (FSA) website.

STATE OF THE UNION: BIDEN PUSHES FOR INVESTMENT IN 'AMERICA'S BEST KEPT SECRET'

Federal student loan forgiveness programs

The Department of Education offers several student debt forgiveness programs to federal borrowers who meet certain eligibility criteria. These include but are not limited to Public Service Loan Forgiveness (PSLF), closed school discharges, borrower defense to repayment discharges and total and permanent disability discharges (TPD).

While the Biden administration has canceled about $16 billion worth of debt for more than 680,000 borrowers under these programs, President Joe Biden has yet to enact widespread student loan relief.

YOU COULD GET A SMALLER TAX REFUND IF YOU RECEIVED CHILD TAX CREDIT PAYMENTS IN 2021

Student loan refinancing

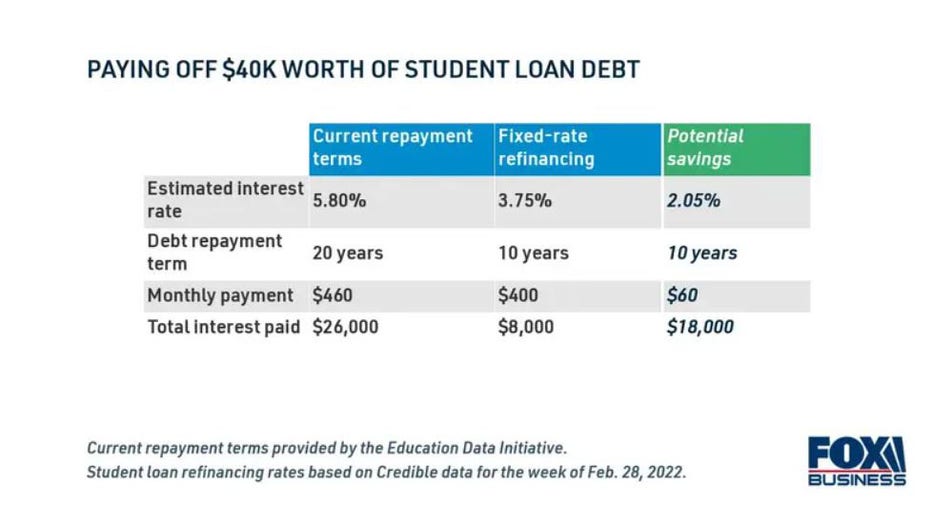

Student loan refinancing is when you take out a new private loan to repay your current student debt under more favorable terms. It may be possible to reduce your monthly payments, pay off debt faster and save money over time by refinancing your student loans at a lower interest rate.

Keep in mind that refinancing your federally held debt into a private student loan would make you ineligible for select protections like IDR plans, COVID-19 administrative forbearance and federal student loan forgiveness. But if you don't plan on utilizing these programs — or if you already have private student debt — then it may be worthwhile to refinance to a lower rate.

You can view current student loan refinance rates from private lenders in the table below. Then, you can use Credible's student loan refinancing calculator to estimate your potential savings and determine if this option is right for your financial situation.

7 OF THE BEST GRADUATE STUDENT LOANS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.