Today's 30-year mortgage rates plunge to 3.750% | March 7, 2022

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

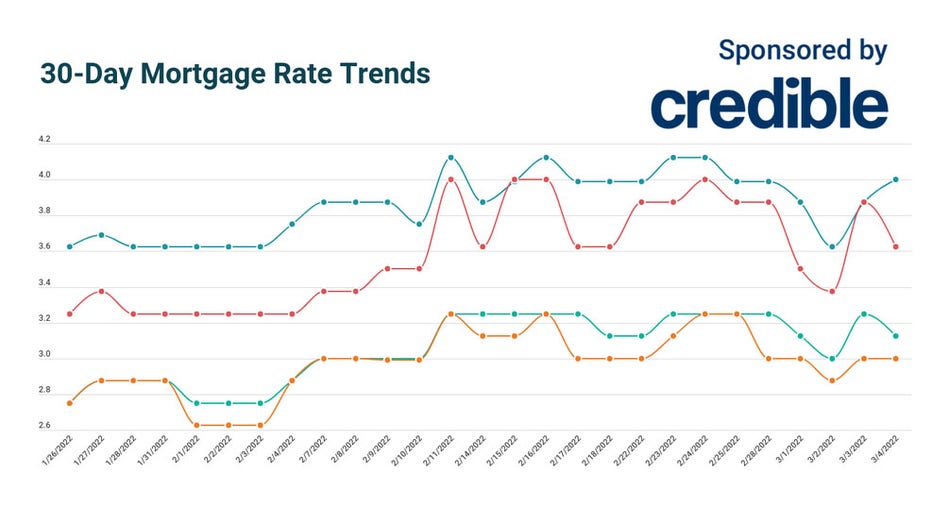

Check out the mortgage rates for March 7, 2022, which are down from last Friday. (Credible)

Based on data compiled by Credible, mortgage refinance rates have largely fallen since last Friday, except for 10-year rates, which remained unchanged.

- 30-year fixed-rate refinance: 3.875%, down from 3.940%, -0.065

- 20-year fixed-rate refinance: 3.500%, down from 3.875%, -0.375

- 15-year fixed-rate refinance: 3.125%, down from 3.250%, -0.125

- 10-year fixed-rate refinance: 3.000%, unchanged

Rates last updated on March 7, 2022. These rates are based on the assumptions shown here. Actual rates may vary. With more than 4,500 reviews, Credible maintains an "excellent" Trustpilot score.

What this means: With mortgage refinance rates falling across 30-, 20-, and 15-year rates today, homeowners who have been wanting to refinance have an opportunity to save significantly on interest. Homeowners who took out their mortgages prior to the pandemic, when rates were much higher, stand to save even more on a refinance.

Today’s mortgage rates for home purchases

Based on data compiled by Credible, mortgage rates for home purchases have fallen across all terms since last Friday.

- 30-year fixed mortgage rates: 3.750%, down from 4.000%, -0.250

- 20-year fixed mortgage rates: 3.500%, down from 3.625%, -0.125

- 15-year fixed mortgage rates: 3.000%, down from 3.125%, -0.125

- 10-year fixed mortgage rates: 2.875%, down from 3.000%, -0.125

Rates last updated on March 7, 2022. These rates are based on the assumptions shown here. Actual rates may vary. Credible, a personal finance marketplace, has 4,500 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

What this means: Homebuyers who have been waiting for a good time to lock in their mortgage rate might consider acting today. Rates opened the week with drops across all terms. Regardless of whether they choose a shorter or longer term, buyers have ample opportunity to reap interest savings over the life of their mortgage. But with mortgage rates already topping 4% multiple times since February, buyers might want to lock in their rate before they go up again.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments.

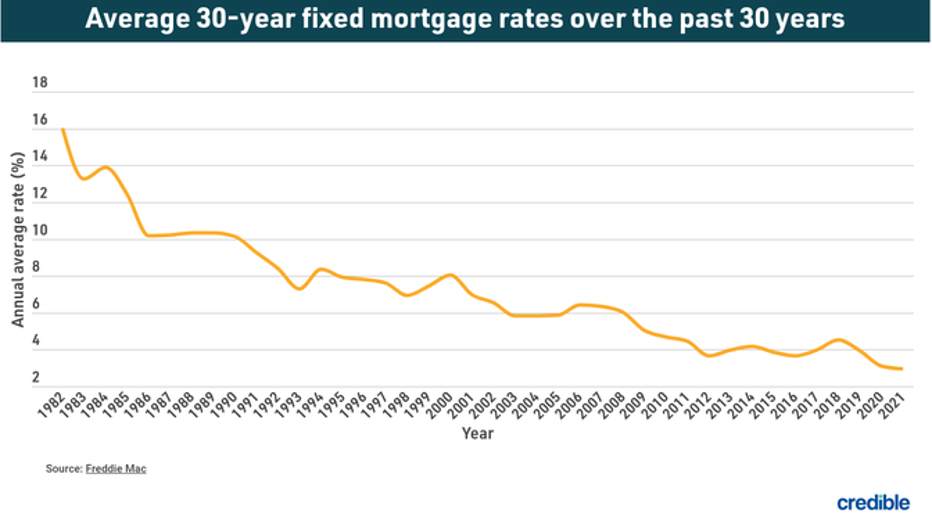

How mortgage rates have changed over time

Today’s mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac — 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of today’s lower interest rates. When considering a mortgage or refinance, it’s important to take into account closing costs such as appraisal, application, origination and attorney’s fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

Are you looking to buy a home? Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credible’s online tools to compare rates and get prequalified today.

Thousands of Trustpilot reviewers rate Credible "excellent."

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

Why do mortgage rates fluctuate?

Here are some of the most common reasons why mortgage rates move frequently:

Employment patterns

The employment rate is an indicator of demand for mortgages. When more people are unemployed, fewer people will be looking to get a mortgage and buy a home — and that lower demand will push interest rates down. When the employment rate improves, demand for mortgages will likely keep pace. And as demand for mortgages rises, so will mortgage interest rates.

The bond market

Because bonds are a lower-risk type of investment, demand for bonds can increase when investors are wary of other investment vehicles, or fearful of the overall state of the economy. Increased demand for bonds causes their price to rise and their earnings — called their yield — to fall.

When bond yields fall, consumer interest rates generally do as well, including mortgage interest rates. When investors feel more confident about the economy, demand for bonds declines, bond prices drop and yields rise. And interest rates tend to follow.

Federal Reserve System

"The Fed," as it’s commonly called, is the United States’ central bank. But it doesn’t actually set mortgage rates. Rather, multiple things the Fed does influence mortgage rates. For example, while mortgage rates don’t mirror the Fed funds rate — the rate banks apply when borrowing lending money to each other overnight — they do tend to follow it. If that rate rises, mortgage rates typically rise in tandem.

Global economy

Global banking systems and economies are closely interconnected. When economies in other parts of the world — especially Europe and Asia — experience a downturn, it affects investors and financial institutions in the United States. And, when foreign economies are doing well, they may attract more American investors — and divert those investment dollars out of the U.S. economy.

If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.