Student loan refinancing saves borrowers nearly $17K, thanks to historically low rates

Borrowers who refinanced student loan debt into a new loan on Credible saved thousands of dollars while decreasing the term of the loan by getting a low, fixed interest rate. Compare your repayment options to decide if refinancing is right for you. (

With student loan refinancing rates hovering near record lows, many graduates are taking advantage of this opportunity to save money on their college debt.

Well-qualified borrowers who refinanced to a shorter-term loan were able to save nearly $17,000 on total interest over the life of their loan, according to a recent Credible analysis. They also shaved years off their debt repayment schedule because they lowered their interest rate.

If you're wondering if refinancing is the right move for you, it's easy to get an idea of your estimated interest rate. You can compare rates from up to 12 student loan refinancing lenders without impacting your credit score on Credible's online marketplace.

10 OF THE BEST STUDENT LOAN CONSOLIDATION COMPANIES

How refinancing to a shorter loan term can save you nearly $17,000

Student loan borrowers who refinanced to a shorter repayment term on Credible's marketplace between Nov. 1, 2019, and Dec. 1, 2020, saved an average of $16,943 on their college debt repayment.

Loan amounts averaged $67,142. Monthly payments went up minimally (by $100), but borrowers were able to shave 41 months off their repayment term. That's thanks in part to lower interest rates: This sample of borrowers saw a 2.29% interest rate reduction, which led to significant interest savings down the road.

Use Credible's student loan calculator to see how much refinancing to a lower interest rate can save you — all without a hard credit inquiry.

HOW TO FIND STUDENT LOANS WITHOUT A COSIGNER

Current student loan refinance rates remain near all-time lows

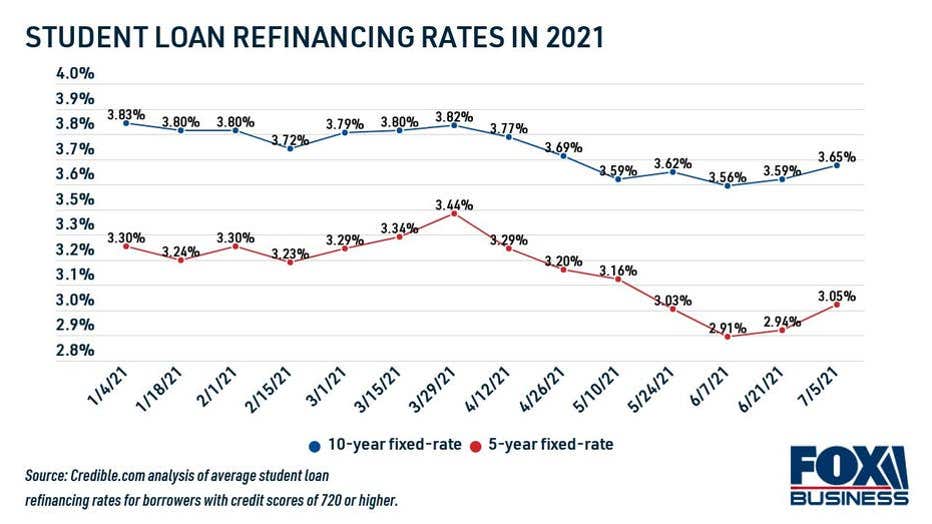

Student loan refinance rates are near historic lows, according to data from Credible. Rates on a 10-year fixed-rate loan averaged 3.65% for borrowers with credit scores of 720 or higher during the week of July 5. That's down from 4.32% just last year. For a 5-year variable-rate loan, rates averaged 3.05%, which is among the lowest they've been in 2021 so far.

MOST BORROWERS AREN'T READY TO RESUME FEDERAL STUDENT LOAN PAYMENTS, SURVEY FINDS

Since lenders don't charge any upfront fees like an origination fee to refinance your student loans, the amount of money you can save when refinancing depends greatly on the interest rate you receive. If you decide to refinance, be sure to compare student loan interest rates across multiple lenders to ensure you're getting a competitive offer.

Use the rate table below to see real interest rates offered by private lenders, and fill out a simple form on Credible to find your rate in just minutes. Shopping around ensures you get the lowest rate possible for your situation.

98% OF PUBLIC SERVICE LOAN FORGIVENESS APPLICATIONS REJECTED

How to know if student loan refinancing is right for you

Refinancing your student loans may be able to save you thousands of dollars over time, but it's not right for everyone. For example, it's not recommended that you refinance your federal student loans, since doing so will make you ineligible for certain federal benefits like hardship forbearance and deferment, income-driven repayment and even student loan forgiveness.

But if you have private student loan debt — and you can qualify for a lower rate — then it may be a good idea to refinance. You may even qualify for an additional automatic payment discount. Doing so can help you pay off your loan faster, lower your loan payment and save money on interest over the life of the loan.

Learn more about student loan refinancing on Credible. You can get in touch with a knowledgeable loans expert who can answer any questions you have about repayment plans and help you decide if student loan refinancing is right for you.

RATES ON FEDERAL LOANS JUMP NEARLY 1% IN JULY: HOW TO MAKE THE MOST OF YOUR OPTIONS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.