2021 was 'fantastic year' for home sales despite low inventory, high prices: RE/MAX

The 2021 housing market was the busiest ever, according to a new RE/MAX report, as a record number of homes sold at a breakneck pace. (iStock)

The past year posed significant hurdles for homebuyers between record-high home prices and record-low housing inventory, according to the latest RE/MAX National Housing Report. But motivated buyers overcame these challenges to make 2021 the busiest year for home sales in the study's 14-year history.

Despite a competitive real estate market, 2021 was a "fantastic year for home sales," according to RE/MAX President and CEO Nick Bailey. The calendar year finished with nearly 10% more home sales than the previous record year of 2020.

"Buyers shrugged off all sorts of potential obstacles – high prices, record-low inventory, stiff competition for available listings – and kept things rolling the entire year," Bailey said.

- RE/MAX President and CEO Nick Bailey

December ended with the smallest number of homes for sale in the history of the annual report. If not for an abysmally low housing supply, home sales could have been even stronger in 2021 thanks to robust buyer demand.

Keep reading to learn more about 2021 housing market trends, as well as the housing forecast for 2022. If you're considering buying a home, visit Credible to begin the mortgage pre-approval process.

HOW TO CHOOSE A REAL ESTATE AGENT

2021 was the busiest home-buying year in report history

Home sales increased 10% between 2020 and 2021, according to the RE/MAX report, which displays a record-setting trend that defies the many roadblocks facing potential homebuyers. Although home sales were stronger than ever, the 2021 housing market posed several challenges:

- Housing supply reached record lows. Housing inventory dropped 33.3% year-over-year, with just 1.2 months of housing supply available on the market in December. The month ended with the smallest number of homes for sale in the report's history.

- Houses are flying off the market. Homes spent an average of 31 days on the market in December 2021, compared with 38 days one year ago. Nashville, Tenn. has the fastest-paced housing market, where the average home spends just 13 days on the market.

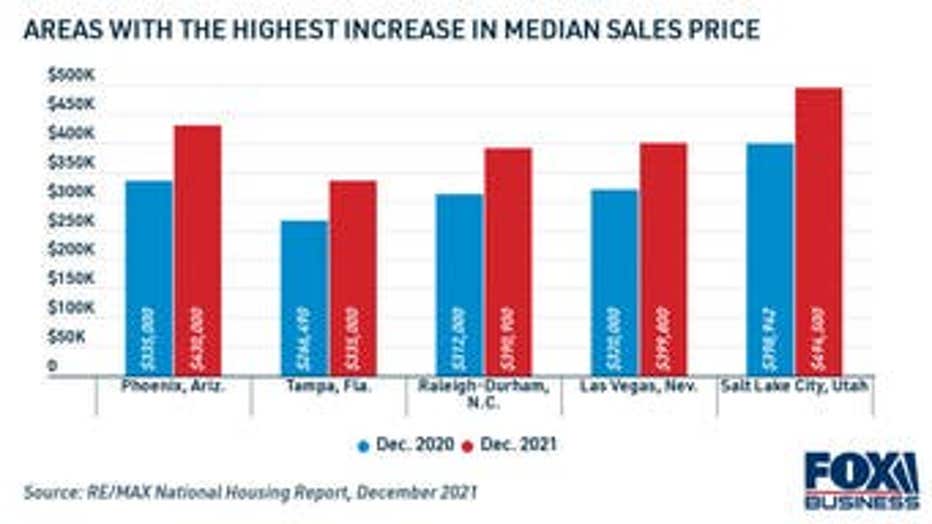

- Home sales prices rose significantly. The median sales price was $335,000 in December 2021, which is up 11.5% from a year ago. No metro areas included in the study saw a year-over-year decrease in sales price, while many cities saw double-digit list price increases.

The strong demand from homebuyers last year was driven in part by historically low mortgage rates. The average 30-year mortgage rate reached a record low of 2.65% in January 2021, according to the Freddie Mac Primary Mortgage Market Survey (PMMS).

Although mortgage interest rates are higher than they were this time last year, they're expected to rise further when the Federal Reserve implements several rate hikes throughout 2022. Potential buyers can consider locking in a lower mortgage rate now on Credible before the Fed raises rates.

MORTGAGE APPLICATIONS SINK TO PRE-PANDEMIC LEVELS

Home sales expected to be strong in 2022

Steady demand from homebuyers led to record-high home sales in 2021, and RE/MAX expects this trend to continue into 2022.

"What's promising for 2022 is that many of the factors which drove record sales in 2021 remain in place," Bailey said. "Interest rates are still attractive, workplace flexibility continues, and many homeowners are sitting on a mountain of equity. If more of them become sellers, there’s ample reason to think the hot streak will continue."

Another factor driving home sales in 2022 will be an increase in inventory. Home builders may finally be able to catch up with the lumber supply and labor shortages that were exacerbated by the coronavirus pandemic, resulting in more single-family homes for buyers to choose from.

Although higher housing supply is expected to alleviate some of the competition that homebuyers faced, rising mortgage interest rates may make homebuying more expensive. The Mortgage Bankers Association (MBA) predicts 30-year mortgage rates to average 4.0% in 2022, up from 3.1% in 2021. This may lead some homebuyers to speed up their purchasing plans in 2022 while they can still lock in a relatively low rate.

You can browse current mortgage rates from multiple lenders in the table below, and visit Credible to see your estimated rate for free without impacting your credit score.

NAHB CEO WARNS SUPPLY CHAIN MUST BE FIXED 'QUICKLY'

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.